Investment Director, Business Oxygen (BO2)

Understanding:

Private Equity and Venture Capital (PEVC) is gaining a lot of interest in Nepal and the number of PEVC firms has been growing. PEVC firms provide equity capital, also termed risk capital, to companies that are looking for capital to expand their businesses. Banks provide debts by collecting deposits from people, in the same analogy, PEVC firms provide equity investment to the companies from a pool of funds created from a limited number of investors. Banks provide debt to both entities and individuals while PEVCs provide investment to entities that are already established businesses or are on a path towards it. Private equity invests in more mature companies as venture capital invests in early-stage companies for higher returns.

Structure:

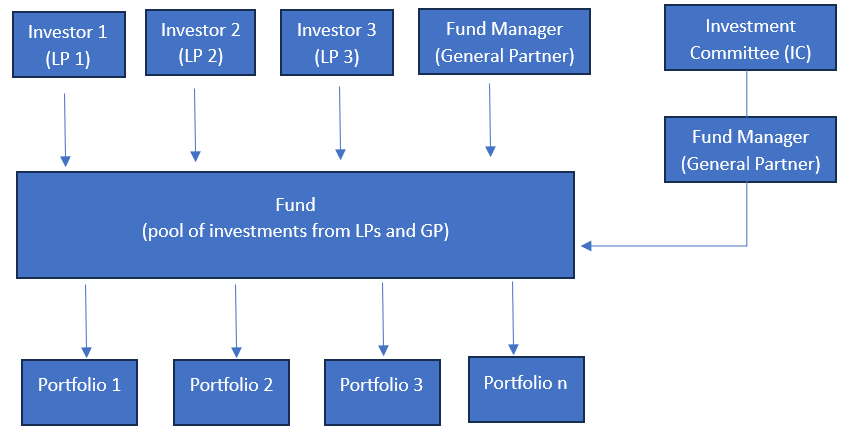

In a PEVC structure, the investors are the Limited Partners (LPs) and the fund managers are the General Partners (GP) of the fund. Funds are an investment pool created with significant commitments from LPs and small commitments from GPs. The role of LPs is limited and are not involved in the day-to-day operation of the fund, they do not take fiduciary risks. It is the responsibility of the GP to manage the fund, which involves deal sourcing, assessing investment proposals, deal structuring, deal negotiation, obtaining required approvals, investment decisions, and providing value-added services including monitoring the portfolio companies and ensuring the exit. It charges management fees to the fund for the fund management services. Traditionally, the 2/20 rule applies – 2% management fee along with 20% participation in profit as carry.

Investment Mandate:

Funds are a commercial finance first model i.e.; funds invest for return from the investment but at the same time they may also focus on the impact creation. Impact doesn’t mean subsidized or low-cost capital, funds may have an environment focus, climate focus, social impact, investments in line with SDGs, and ESG implementation among others. The impact is not a byproduct but a conscious outcome from investments along with the return. Funds have their own mandates and investment policies which define the sector and areas of investment, investment period, fund tenure, size of investment (ticket size), stage of the portfolio company to invest, and other investment criteria. The investment committee (IC) is the governing body of the fund and comprises senior members from the fund management team and independent experts. IC decides on the investment or divestment proposals from the fund manager and ensures that the fund is operated as per the mandate.

Investment Process:

PEVC investments take longer time compared to debt financing; as there is no collateral involved risk is high and the process is stringent. After an application is received thorough review of the financials and business plan is done by the fund manager, a site visit of the premise is conducted, several rounds of meetings are conducted to understand the business, industry, and investment needs, and an independent due diligence is done before final decision is made by the management. The management team then forwards the proposal to the IC which makes the final call.

Differentiator

PEVC investment is equity capital costlier than debt financing but less risky than debt financing. There are no collateral requirements, and no EMIs, and the structure can be customized in each deal in PEVC investment. Technical assistance (TA), network and handholding approach from investment to exit are the differentiators. The success of the fund depends on the success of the portfolio companies. Funds make money when the value of the portfolio company grows and the exit happens at higher multiples. Therefore, funds are equally involved and closely monitor the portfolio companies to help incorporate the best governance, financial, and management practices to prepare for the planned expansion. PEVC firms empower entrepreneurs to operate the business but funds cannot be expected to be involved in daily business operations.

Right capital Mix

Depending upon the existing capital mix, business plan, investment need, stage of the company, risk involved, gestation period, and need for collaboration, an entrepreneur can decide on the type of financing it needs. The right mix of debt and equity investment can provide a sustainable return at lesser risk. One of the fears of entrepreneurs for equity investment is dilution. PEVC funds are close-ended funds which means they have to close after a certain period. Hence, exit is mandatory, entrepreneurs have an opportunity to own 100% of their business at the end of the investment period.

Leave a Reply