Nepal has been left behind due to insurgency and a prolonged political transition of over 2 decades. Nepal has had more than 32 governments between 1990 and 2022. Nepal is at a crossroads being located in one of the most economically dynamic regions in the world but remains one of Asia’s poorest economies. The economy is mainly import-based and remittance-dependent. Remittances have supported the improvement in Nepal’s economic indicators, but there always remains a risk because the demand for Nepali migrant workers is not in our control.

More than 70% of the population is engaged in agriculture but it contributes less than 30% to the GDP. Adoption of technology, commercialization of farming, and more efficient value chains should see this sector leapfrog in the coming decade. In developed economies, SMEs contribute more than 50 % to GDP but in Nepal, the contribution is less than 22 %. With the beginning of Privatization from the 1990’s the most formal firms are privately owned. With the exception of a few large business groups most of the firms are small. However, the overall productivity levels remain low. SMEs play a major role in most economies, particularly in developing countries. SMEs account for the majority of businesses worldwide and are important contributors to job creation and global economic development. They represent about 90% of businesses and more than 50% of employment worldwide. As per the World Bank, 7 out of 10 jobs are created by the SMEs. SMEs play a pivotal role in the development of the country. In the case of Nepal, SMEs generate around 17 lakh employments. Nepal with a goal to reach a middle-income country by 2030 there should be more involvement of the private sector to trigger the response required for the country goal ambitions.

In Nepal it is an arduous task for SMEs to raise growth capital as it is difficult to obtain a loan, as banks compulsorily require collateral in most cases There are some schemes where a loan is provided without collateral but the ceiling amount is very low. So, the founders have to rely on internal funds or cash from friends and family. As per the study by NRB, 33 % use ancestral properties, 26 % use personal savings, 16 % take loans from BFI, 6% take loans from cooperatives and 0.5 % take from venture capital funds to start the business. As per the International Finance Corporation formal micro, small, and medium entities in developing countries have an unmet financing need of $5.2 trillion every year and the situation is the same in our country. If we take the worldwide data, half of the formal SMEs don’t have access to formal credit. The financing gap is even higher when micro and informal enterprises are taken into account. In the case of Nepal as per NRB only half of SMEs take loans from BFI amongst which 85 % of SMEs take loans from commercial banks. The majority of SMEs take loans of less than 5 million and on average SMEs require 38 days to get a loan from the BFI’s. The main problem with obtaining a loan has been the inconveniences in the processes, high-interest rates, and the lack of collateral. In addition, a majority of SMEs do not know about various programs that exist for SME loans. That is why the use of concessional loans remains negligible whereas SME refinancing has not been effective.

For a country like Nepal trade can be an important engine for growth but sadly Nepal has not been able to exploit new markets or diversify its exports. This can be validated from the data that Nepal’s exports to GDP have fallen from 25 % in the 1990s to 10 % currently. Since 2000, Nepal’s merchandise exports have grown at a meager 0.5 percent per year. We believe SMEs will be the ones who will reduce imports, increase exports, and create employment opportunities. We can say that because Nepali youth are naturally entrepreneurial, inadequate capital and business management skills keep us small. Nepal produces more than 5,000 IT graduates each year. Many of them end up migrating to Western countries due to a lack of opportunities in the country. But now returning migrants are beginning to bring back capital and skills to some extent. There is a desire and willingness to achieve scale amongst most SMEs. We Nepali Entrepreneurs are the next generation of leaders. We are the leaders tapping the sectors with unrealized potential, overcoming the challenges. Many entrepreneurs in Nepal start companies with a strong commitment to solving problems that they often experience themselves. This drive to make things better – bound by the fact that we have lived through these challenges – makes us resilient in the face of any hardship, including a major earthquake, and keeps us 100% committed. With our commitment to problem-solving, we lead our communities towards change. We personalize a sense of responsibility towards our communities and understand that responsibility is a key pillar of Leadership. I believe Nepal was ready for business never like before because:

- There is improved political stability.

- Electricity supply is on track.

- Most of the sectors such as tourism, IT, and agriculture are underutilized and offer tremendous growth opportunities.

- The average age of the population is 22 offering a window of a few decades to tap into a productive, tech-progressive workforce.

- The government has made efforts to strengthen competition, generate a more conducive environment for investment, and reduce corruption.

- Economic growth is the state’s primary agenda to graduate to a middle-income country by 2030.

There are various sectors that have competitive advantages and can scale up if properly guided. Some of the sectors are:

- Tourism: High Feasibility due to unique natural endowments.

- Agri-Business: High feasibility due to unique and diverse Agri-climatic conditions.

- IT Sector: Low Labor costs are an advantage and information and Communication Technology exports are less sensitive to transport cost constraints.

- Education: Education enables other sectors and youth can be engaged more productively.

With the target of being a middle-income country by 2030, the government should be prudent and careful while forming rules and regulations. It should be formulated after a detailed study. The FDI inflows have been dismal compared to peer nations. FDI inflows have remained negligible and substantially below 1 percent of GDP. The government should establish a platform to conduct regular dialogue between Young Entrepreneurs and itself to address pain points and coordination. The Foreign Investment Act should be aligned with international best practices. I hope the government will understand the value of SMEs and make the policy that allows the economy to escalate.

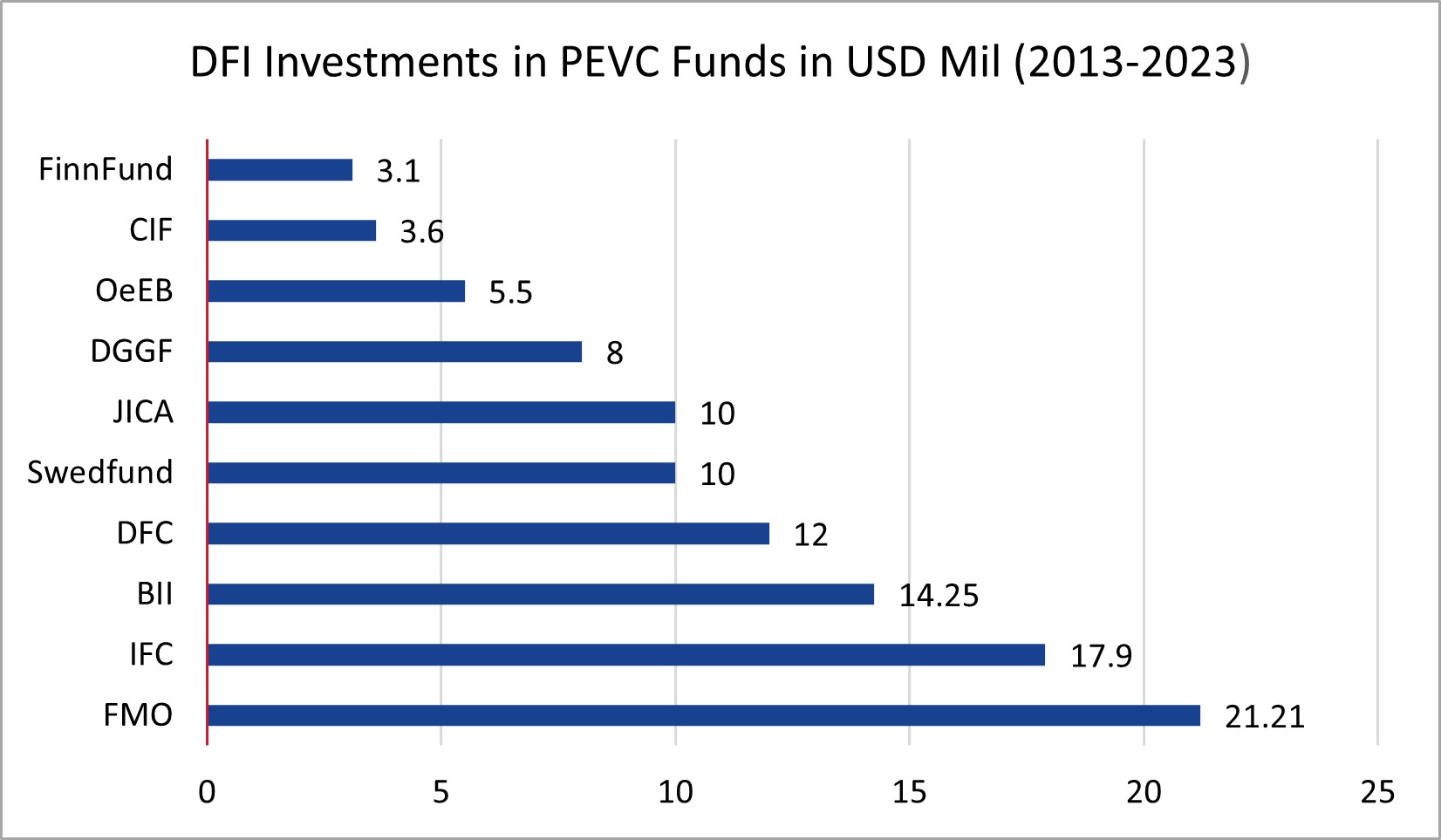

Further Start-ups/Small and medium Enterprises are like a boat in a rough sea, which is at the mercy of the winds for its movement. Therefore, it becomes important to steer the boat in the right direction. Aside from government support, Private Equity (PE), Venture Capital (VC) firms and Banking and Financial Institutions (BFIs)should play a crucial role in helping SMEs grow. They are like essential partners that can guide and support these small businesses, helping them overcome challenges and succeed in their ventures.

Reference:

World Bank Report: Maximizing Finance for Development 2018

World Bank Report: Creating Market in Nepal: Country Private Sector Diagnostic 2018

SMEs Financing in Nepal 2076, Nepal Rastra Bank

Leave a Reply