In the dynamic realm of emerging economies, the role of Development Finance Institutions (DFIs) has proven instrumental in propelling sustainable economic growth and realizing the objectives set forth in the Sustainable Development Goals (SDGs). This holds particularly true for countries like Nepal, where the infusion of DFI investments into private equity and venture capital funds has become a powerful catalyst for innovation, job creation, and overall development.

DFIs, backed by economically developed nations, serve as crucial pillars in providing financial support to commercially viable private sector projects in developing nations. These investments are often channeled through financial intermediaries such as financial institutions and private equity & venture capital funds, effectively bridging the gap in access to capital and supporting projects that might otherwise struggle to secure funding from traditional sources.

DFIs play a dual role as cornerstone investors, injecting momentum into private equity funds and contributing to successful initial closures. Their involvement provides a positive signal to the market, attracting additional commercial capital by conducting thorough due diligence on projects that may have been overlooked by private investors. Furthermore, DFIs champion the development of environmental, social, and governance (ESG) standards within the private sector, emphasizing the broader impact of their investments.

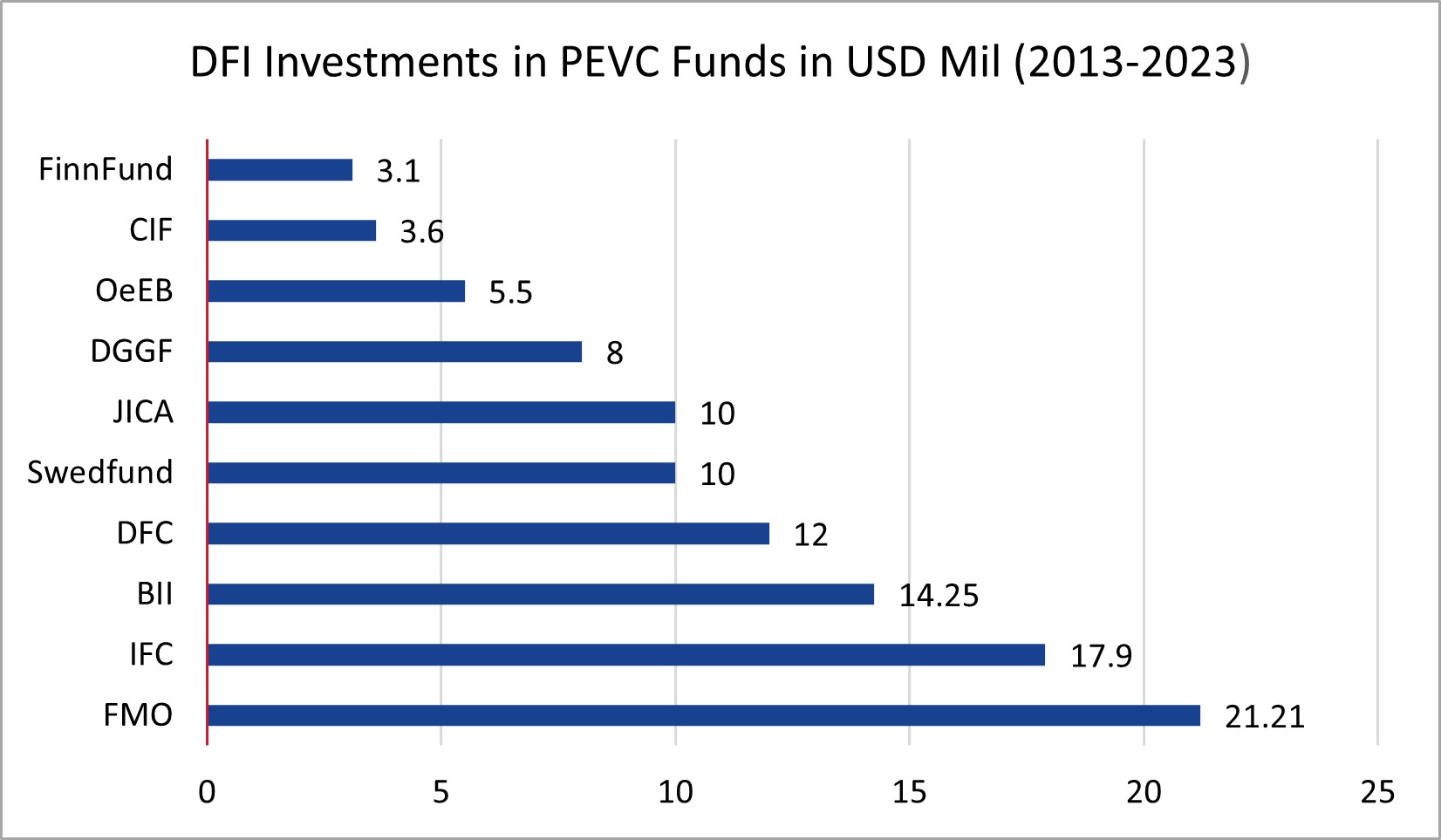

The social benefits of DFI investments in private equity funds are manifold, ranging from employment generation to increased exports and the creation of products or services not readily available. This support fosters the development of local industries and elevates social considerations on the private equity industry’s agenda. DFIs, including notable entities like the International Finance Corporation (IFC), the Dutch Entrepreneurial Bank (FMO), and British International Investment (BII), actively share financial risks, provide loans, and take minority equity stakes, contributing to long-term, sustainable impact.

As Nepal transitions from a least developed country to a developing nation, the need for long-term finance to fuel growth across various sectors becomes paramount. DFI investments in Nepalese private equity funds have emerged as a crucial lifeline, particularly supporting sectors such as infrastructure, agriculture, tourism, ICT, and small and medium enterprises (SMEs).

The current landscape in Nepal boasts a diverse array of funds, including funds under Local Funds Registered Under the Company Act, under Local Fund Managers Registered, Under the Specialized Investment Fund (SEBON), and DFI-backed funds, Dolma Impact Fund, Business Oxygen, and One to Watch. Notably, DFIs like FMO, BII, DGGF, IFC, Finnfund, and others have collectively invested approximately $105.56 million between 2013 and 2023.

Note: These data are compiled using publicly available sources.

Dolma Impact Fund stands out as a frontrunner, closing significant DFI investments. Dolma Impact Fund II secured $66.25 million, and Dolma Impact Fund I secured $27.81 million, underscoring the pivotal role of select funds in attracting substantial DFI backing.

Note: These data are compiled using publicly available sources.

Nepal’s proactive approach to creating an investment-friendly environment is evident through recent regulatory reforms. For example, amendments in the lock-in period for foreign investments have reduced barriers for foreign investors, signaling a commitment to attracting foreign direct investment (FDI) in the PEVC sector as well.

In conclusion, the upward trajectory of DFI investments in Nepal’s private equity landscape signifies a positive shift towards sustainable development. As DFIs continue to catalyze innovation, job creation, and economic growth, Nepal stands poised to leverage these investments for long-term prosperity. The partnership between DFIs and private equity funds is not merely financial but a powerful force shaping the future of emerging economies like Nepal, empowering them to realize their full growth potential.

Leave a Reply